Table of Contents

- Executive Summary: Key Insights and 2025 Outlook

- Market Size & Growth Projections Through 2030

- Latest Technology Innovations in Epitope Mapping

- Competitive Landscape: Leading Manufacturers and New Entrants

- Key Applications Across Biopharma, Immunology, and Diagnostics

- Regulatory Landscape and Compliance Developments

- End User Analysis: Academia, CROs, and Biotech Firms

- Regional Trends: North America, Europe, Asia-Pacific, and Beyond

- Future Opportunities: AI Integration, Automation, and Miniaturization

- Challenges, Risks, and Strategic Recommendations for Stakeholders

- Sources & References

Executive Summary: Key Insights and 2025 Outlook

Peptide epitope mapping instruments are poised at the center of rapid innovation in immunology, vaccine development, and therapeutic antibody discovery. As of 2025, demand for high-throughput, automated, and multiplexed solutions is escalating, driven by pharmaceutical R&D, biotechnological advances, and the growing complexity of modern biologics pipelines. Peptide epitope mapping—crucial for defining antigen-antibody interactions—has become indispensable in both preclinical and clinical research, with instruments enabling precise, reproducible, and scalable mapping workflows.

A major trend in 2025 is the shift toward highly integrated, automated platforms that streamline the entire epitope mapping process. Established instrument manufacturers such as Cytiva and Biolytic Lab Performance Inc. are continuing to enhance peptide synthesizer capabilities, allowing for rapid parallel synthesis of peptide libraries. These advances have reduced turnaround times from weeks to days, accelerating discovery pipelines and enabling more iterative candidate screening.

In parallel, multiplexed array technologies are gaining traction. Companies like JPT Peptide Technologies and Pepscan are expanding their offerings for peptide microarray instruments and services. These platforms allow simultaneous interrogation of hundreds to thousands of potential epitopes, supporting both linear and conformational mapping, and facilitating large-scale immune monitoring and vaccine target validation.

Integration with high-sensitivity detection systems is another area of focus. Real-time data acquisition, enabled by advanced surface plasmon resonance (SPR), fluorescence, or mass spectrometry modules, is increasingly standard. Instrument providers such as Bruker are innovating in mass spectrometry-based epitope mapping, supporting comprehensive characterization of antibody-antigen interactions at the peptide level.

Looking ahead to the next few years, the outlook for peptide epitope mapping instruments is robust. Continuous improvements in automation, miniaturization, and informatics integration are anticipated. The convergence of synthetic biology, machine learning, and next-generation sequencing with epitope mapping workflows is expected to further enhance throughput and predictive accuracy. Regulatory emphasis on biosimilar and biotherapeutic characterization, as well as heightened interest in pandemic preparedness, will continue to drive instrument adoption across global markets.

In summary, 2025 marks a period of strong growth and technological refinement for peptide epitope mapping instruments. Market leaders and new entrants alike are investing in solutions that meet the rising demands for precision, scalability, and data-rich outputs, ensuring these instruments remain integral to the future of immunological research and therapeutic innovation.

Market Size & Growth Projections Through 2030

The global market for peptide epitope mapping instruments is expected to demonstrate robust growth through 2030, driven by expanding applications in immunotherapy, vaccine development, and biopharmaceutical R&D. In 2025, the sector is characterized by growing adoption among academic and industry laboratories seeking high-throughput, precise identification of antibody- and T-cell epitopes. Key players in this space, such as Thermo Fisher Scientific, Biomatik, and Intavis, continue to innovate in instrumentation and workflow automation, broadening the accessibility and speed of mapping technologies.

Current estimates suggest the peptide epitope mapping instrumentation market will experience a compound annual growth rate (CAGR) in the high single to low double digits through 2030. This growth is underpinned by substantial increases in antibody discovery and validation projects, especially in oncology and infectious disease research. Furthermore, the integration of automation and multiplexing capabilities—offered by platforms from JPT Peptide Technologies and Pepscan—enables higher throughput and more detailed epitope characterization, supporting both basic science and translational medicine pipelines.

North America leads the market in 2025, attributed to the concentration of biopharma companies and world-leading research institutions. However, strong growth trajectories are also projected in Europe and the Asia-Pacific region, where increasing government funding and expanding biotech sectors stimulate demand for advanced mapping platforms. The introduction of benchtop and turnkey instruments is further democratizing access, enabling smaller labs to undertake detailed immunogenicity and specificity analyses.

Notably, the continued evolution of peptide microarray technology, as seen in the product lines of JPT Peptide Technologies and Intavis, is anticipated to lower per-sample costs and improve data quality. In parallel, partnerships between instrument manufacturers and bioinformatics software providers are expected to enhance data interpretation and visualization, a key market differentiator going forward.

Looking to 2030, the peptide epitope mapping instruments market is poised for continued expansion, fueled by the convergence of personalized medicine trends, regulatory emphasis on product characterization, and rising demand for next-generation biologics. As product portfolios mature and multiplexing reaches new throughput milestones, the competitive landscape will likely intensify—rewarding companies that deliver integration, reliability, and cost-effectiveness in their instrumentation offerings.

Latest Technology Innovations in Epitope Mapping

Peptide epitope mapping instruments have undergone notable technological advancements leading into 2025, driven by the increasing demand for precise antibody characterization in therapeutic and vaccine development. The latest generation of these instruments emphasizes high-throughput automation, multiplexing, and integration with advanced data analytics, enabling researchers to accelerate the identification of critical binding sites on target antigens.

A primary innovation is the deployment of high-density peptide microarrays, which allow for simultaneous screening of thousands of overlapping peptides. Companies such as JPT Peptide Technologies and INTAVIS Bioanalytical Instruments have introduced platforms capable of synthesizing and assaying complex peptide libraries in a single run. These instruments support rapid, parallelized mapping of linear and, increasingly, conformational epitopes, addressing the growing complexity of next-generation biologics.

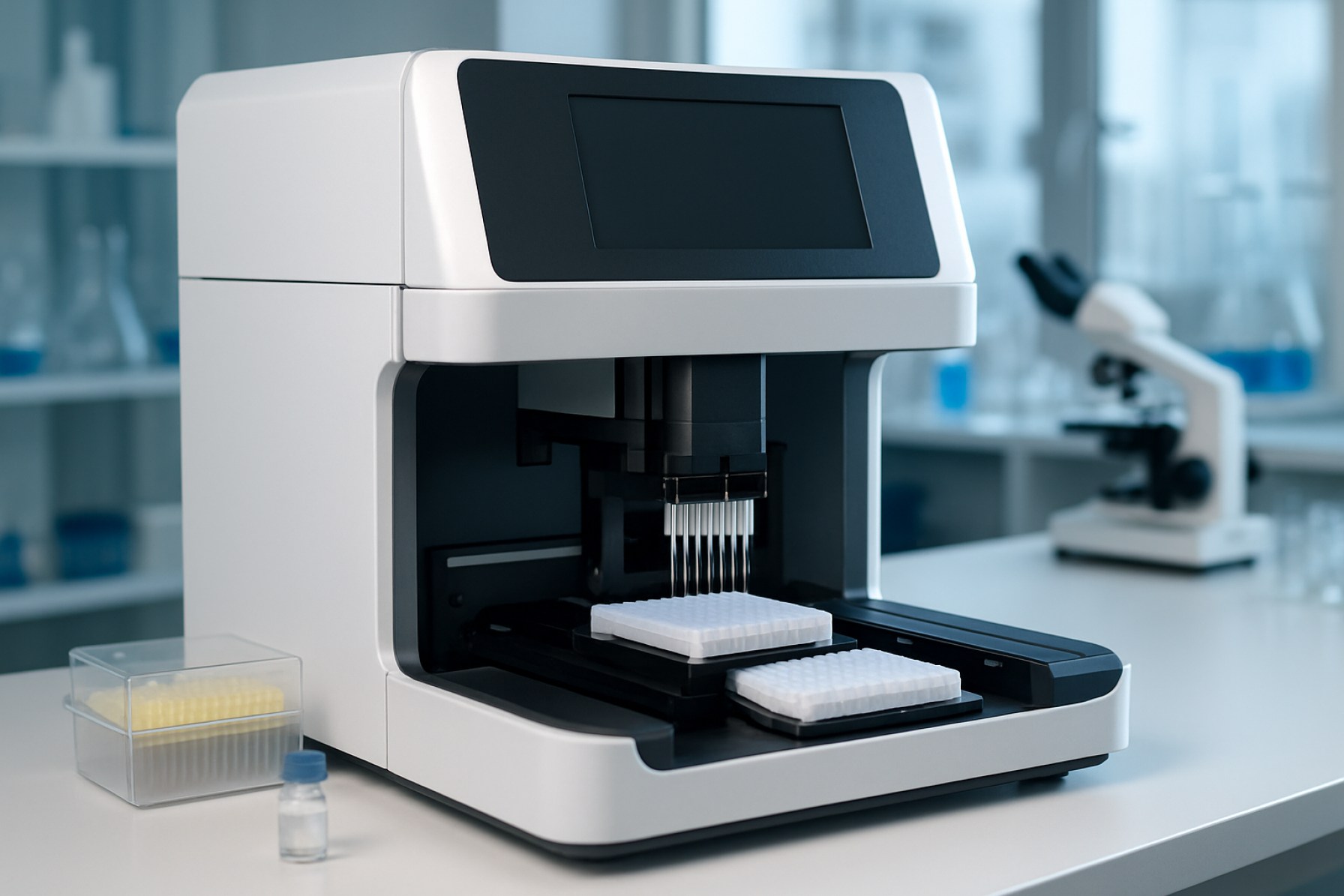

Another significant trend in 2025 is the integration of peptide synthesis platforms with advanced liquid handling robotics and automated imaging systems. This convergence, exemplified by systems from Bio-Rad Laboratories, facilitates not only higher throughput but also greater reproducibility and reduced sample consumption—an essential factor given the rising costs of custom peptide synthesis and precious clinical samples.

Instrument manufacturers are also focusing on enhancing detection sensitivity. Next-generation array scanners and label-free detection technologies, such as surface plasmon resonance (SPR) and interferometry-based readouts, are being incorporated into peptide epitope mapping workflows. These approaches, championed by companies like Cytiva, enable real-time measurement of antibody-epitope interactions, providing kinetic and affinity data critical for therapeutic antibody development.

Software innovation accompanies hardware advances, with machine learning algorithms increasingly embedded into instrument software suites. This enables automated pattern recognition, deconvolution of overlapping signals, and integration with structural biology databases for epitope prediction and visualization. Such features are particularly relevant as the pharmaceutical industry expands into personalized immunotherapies, where rapid epitope identification is vital.

Looking ahead, the outlook for peptide epitope mapping instruments is marked by continued miniaturization, broader adoption of microfluidic chip-based systems, and enhanced interoperability with downstream analytical tools such as mass spectrometry and next-generation sequencing. As biopharma pipelines become more reliant on epitope-level insights, these instrumentation innovations are set to play a pivotal role in expediting discovery and optimizing candidate selection through 2025 and beyond.

Competitive Landscape: Leading Manufacturers and New Entrants

The competitive landscape for peptide epitope mapping instruments in 2025 is characterized by a blend of established analytical technology leaders and a wave of innovative entrants. These instruments are pivotal in immunology, vaccine design, and therapeutic antibody development, driving demand for platforms that deliver high-throughput, resolution, and automation. The sector is undergoing rapid evolution as companies respond to increasing demands from biopharma and academic research.

Leading the market are established manufacturers such as Thermo Fisher Scientific, Bruker, and Sartorius, each offering instrument solutions that combine peptide synthesis, microarray technology, and advanced detection modalities. Thermo Fisher Scientific continues to expand its capabilities in epitope mapping, integrating mass spectrometry and peptide array platforms to improve sensitivity and throughput for clinical and research applications. Bruker, known for its mass spectrometry and molecular analysis solutions, has tailored its instruments to support fine epitope characterization, with ongoing updates to hardware and software anticipated through 2025. Sartorius, with its focus on bioprocess analytics, is leveraging single-cell analysis and label-free detection to streamline epitope identification workflows.

Specialized companies such as JPT Peptide Technologies and Pepscan are recognized for their dedicated peptide array platforms. They offer high-density peptide microarrays and custom mapping services used extensively by pharmaceutical and academic clients. JPT, in particular, has invested in automation and data analytics for its PepStar platform, aiming to accommodate increasing project volumes and complex mapping needs. Pepscan’s CLIPS technology remains central to its mapping services, with enhanced instrument integration expected in the near term.

Meanwhile, the sector is witnessing new entrants fueled by advances in microfluidics, surface chemistry, and digital assay integration. Startups and university spinouts are introducing benchtop devices with AI-powered sequence analysis, compact footprints, and cloud-based data management. These players, while not yet matching the scale of established manufacturers, are anticipated to accelerate innovation cycles and push for more affordable, user-friendly systems by 2026.

Collaborations are intensifying: instrument makers are partnering with reagent suppliers and bioinformatics firms to deliver turnkey solutions. For instance, joint ventures between mass spectrometry manufacturers and peptide synthesis companies are expected to yield hybrid platforms with enhanced mapping throughput and data precision. With the rising importance of personalized immunotherapy and infectious disease surveillance, the outlook for peptide epitope mapping instruments points to sustained growth, broadening competition, and further technological convergence over the next several years.

Key Applications Across Biopharma, Immunology, and Diagnostics

Peptide epitope mapping instruments have become fundamental to the advancement of biopharma, immunology, and diagnostics, particularly as the demand for precise, rapid, and high-throughput immunological characterization continues to surge in 2025. These instruments enable detailed identification of linear and conformational epitopes—critical for the development of monoclonal antibodies, vaccines, and targeted immunotherapies.

In the biopharmaceutical sector, peptide epitope mapping is instrumental for antibody drug development and validation. Leading manufacturers such as Intavis and Thermo Fisher Scientific have introduced advanced peptide synthesizers and array platforms, allowing researchers to comprehensively screen for antibody-epitope interactions at scale. The ability to rapidly map epitopes accelerates lead candidate selection and de-risking in preclinical pipelines, a trend that is projected to intensify as biopharma continues to prioritize speed-to-market and biosimilar development.

In immunology, epitope mapping instruments underpin major advances in understanding immune responses to infectious diseases and autoimmune disorders. Companies like JPT Peptide Technologies provide custom epitope mapping services and arrays, supporting both academic research and translational studies. The technology is particularly vital for dissecting T-cell and B-cell epitope repertoires, supporting the design of next-generation vaccines—evident in ongoing COVID-19 and emerging pathogen research.

Diagnostics is another key application area, where high-throughput peptide arrays facilitate the development of multiplexed assays for disease biomarkers and allergy panels. Sengenics and Pepscan have expanded offerings in this space, enabling the profiling of patient antibody responses for both research and clinical diagnostic use. In 2025, integration of epitope mapping data into diagnostic platforms is expected to enhance precision medicine approaches, particularly in oncology, infectious diseases, and allergy testing.

Looking ahead, the convergence of automation, miniaturization, and advanced data analytics is poised to further transform the landscape. Many manufacturers are developing next-generation instruments with improved throughput, sensitivity, and integration with bioinformatics pipelines, supporting both large-scale biopharma workflows and specialized clinical applications. As regulatory emphasis on characterization and reproducibility grows, adoption of peptide epitope mapping instruments across these sectors is set to accelerate, solidifying their role as a cornerstone of modern biomedical innovation.

Regulatory Landscape and Compliance Developments

The regulatory landscape for peptide epitope mapping instruments is undergoing significant evolution in 2025 and is expected to continue developing over the next few years. Driven by increased adoption of biologics, personalized medicine, and immunotherapy, regulatory agencies worldwide are refining requirements for analytical instrumentation used in the characterization of epitopes, particularly for applications in vaccine and therapeutic antibody development.

In the United States, the U.S. Food and Drug Administration (FDA) continues to emphasize the necessity for validated, robust analytical platforms as part of Biologics License Applications (BLAs) and Investigational New Drug (IND) submissions. The FDA’s Quality by Design (QbD) and process analytical technology (PAT) initiatives specifically call for high reproducibility and traceability in epitope mapping workflows, impacting instrument design and data management functionalities. Instruments from leading providers such as Bruker, Sartorius, and SCIEX are increasingly incorporating compliance features like electronic records in accordance with 21 CFR Part 11, audit trails, and secure user access controls to meet these evolving regulatory demands.

In Europe, the European Medicines Agency (EMA) is maintaining close alignment with ICH guidelines, emphasizing standardization in the characterization of biological products. The EMA has issued recommendations on the validation of epitope mapping assays, requiring comprehensive documentation of instrument calibration, maintenance, and performance qualification. The Medical Device Regulation (MDR, Regulation (EU) 2017/745) also has implications for peptide epitope mapping instruments marketed as in vitro diagnostic (IVD) devices, mandating more rigorous conformity assessments.

Asia-Pacific regulatory environments—particularly those in Japan, South Korea, and China—are accelerating harmonization with global standards. The Pharmaceuticals and Medical Devices Agency (PMDA) in Japan and the National Medical Products Administration (NMPA) in China have announced updated guidelines for analytical method validation that specifically reference the need for high-resolution, automated epitope mapping technologies. This is prompting instrument manufacturers to increase investment in compliance-supporting software and documentation tailored to regional expectations.

Looking ahead, the outlook for compliance is shaped by the ongoing digitalization of laboratory workflows and the anticipated introduction of new regulatory frameworks for advanced therapeutics. Instrument providers are expected to further integrate cloud connectivity, advanced cybersecurity, and AI-driven data integrity solutions to align with the anticipated requirements of both existing and upcoming regulations. Active dialogue between industry stakeholders and regulatory authorities is likely to continue, shaping instrument development priorities and compliance strategies for peptide epitope mapping instruments into the late 2020s.

End User Analysis: Academia, CROs, and Biotech Firms

Peptide epitope mapping instruments are critical tools in immunology and biotherapeutics research, enabling precise identification of linear and conformational epitopes. As of 2025, the end user landscape is defined primarily by three segments: academic research institutions, contract research organizations (CROs), and biotech firms. Each group demonstrates distinct usage patterns, procurement strategies, and impacts on instrument adoption and innovation.

Academic institutions continue to represent a substantial portion of the market, driven by fundamental research into immune responses, infectious diseases, and vaccine development. Leading universities and research centers prioritize flexibility and multi-user capabilities, often favoring platforms that integrate with existing peptide synthesis and screening systems. Instruments from major manufacturers such as Thermo Fisher Scientific and Merck KGaA are commonly deployed in core facilities, supporting collaborative projects and grant-funded studies. Growing funding for immunology and personalized medicine research in the US, EU, and Asia-Pacific regions is forecasted to sustain high academic demand through at least 2028.

CROs are experiencing pronounced growth as biopharma companies increasingly outsource epitope mapping to accelerate preclinical and clinical development. CROs prioritize high-throughput, automation-ready instruments capable of handling large peptide libraries and delivering rapid, reproducible results. The adoption of platforms from providers like Intavis Bioanalytical Instruments and GenScript Biotech Corporation reflects the sector’s need for scalability and compliance with regulatory standards. A key trend in 2025 is the expansion of CRO service offerings to include detailed epitope mapping for novel antibody therapies and next-generation vaccines, especially as mRNA and cell therapies enter later-stage trials.

Biotech firms—ranging from early-stage startups to established biopharmaceutical companies—are significant end users, often integrating peptide epitope mapping early in discovery pipelines. These firms seek customizable, modular instruments to support rapid iteration in antibody engineering and antigen discovery. The current market sees robust interest in platforms that offer seamless data integration and compatibility with downstream bioinformatics, as offered by instrument makers like Biomatik and Pepscan. As the biotech sector leads in innovation for cancer immunotherapy, allergy therapeutics, and infectious disease vaccines, demand is expected to rise for next-generation mapping systems with enhanced sensitivity and multiplexing capabilities.

Looking ahead, the convergence of automation, miniaturization, and advanced analytics is expected to shape procurement preferences across all end user segments. Academic centers will benefit from shared-access, multi-application platforms, CROs from throughput and compliance, and biotech firms from flexible and integrative systems. Overall, the next few years are likely to witness continued expansion in instrument deployment and feature innovation, mirroring the rapid pace of discovery in immunology and therapeutic development.

Regional Trends: North America, Europe, Asia-Pacific, and Beyond

Peptide epitope mapping instruments are crucial for characterizing antibody specificity, vaccine development, and immunotherapy research. In 2025, regional trends in North America, Europe, Asia-Pacific, and other markets reflect varying levels of technological adoption, investment, and market maturity.

North America remains the leading market for peptide epitope mapping instruments, underpinned by a robust biopharmaceutical sector, high R&D spending, and a concentration of key players. Major instrument manufacturers such as Thermo Fisher Scientific and Bruker Corporation are headquartered in the US, driving innovation and early access to advanced platforms. The region benefits from high-throughput screening capabilities and an expanding focus on precision medicine, particularly in antibody and T-cell epitope discovery. Numerous collaborations between academia and industry, as seen in partnerships with institutions like the National Institutes of Health, are accelerating technology deployment and validation.

Europe is characterized by strong support for translational research through public funding and cross-border initiatives. Countries like Germany, the UK, and Switzerland host several leading instrument developers such as Sartorius and Cytiva (operating Biacore systems), fostering a vibrant ecosystem for epitope mapping innovation. European regulatory frameworks and consortia such as the Innovative Medicines Initiative are encouraging standardized workflows and data sharing, which is expected to accelerate the clinical translation of discoveries made with these instruments over the next few years.

Asia-Pacific markets are witnessing rapid growth, driven by increasing investments in biotech infrastructure, particularly in China, Japan, and South Korea. Regional manufacturers such as Shimadzu are expanding their portfolios to include peptide mapping solutions, while local research institutes are forming partnerships with global instrument suppliers to build capacity. The region’s strong emphasis on biosimilar and vaccine research is expected to drive demand for both entry-level and high-throughput epitope mapping instruments through 2025 and beyond.

Other regions, including Latin America and the Middle East, are beginning to adopt peptide epitope mapping instruments, though progress is slower due to limited funding and infrastructure. However, increasing participation in global clinical trials and international collaborations suggest a gradual rise in adoption rates.

Across all regions, the push toward automation, integration with informatics tools, and miniaturization is shaping the outlook for the next few years. Instrument makers are increasingly focusing on user-friendly platforms to address the needs of both established research centers and emerging markets, suggesting a broader global diffusion of peptide epitope mapping technologies by the end of the decade.

Future Opportunities: AI Integration, Automation, and Miniaturization

The landscape for peptide epitope mapping instruments is rapidly evolving, with artificial intelligence (AI), automation, and miniaturization poised to redefine capabilities and workflows by 2025 and beyond. AI is increasingly being integrated into epitope mapping platforms to accelerate data analysis, enhance pattern recognition, and optimize experimental design. For instance, machine learning algorithms are now leveraged to predict immunogenic regions and interpret large datasets generated from high-throughput mapping, reducing manual intervention and expediting discovery timelines.

Automation is another major trend, with new generations of peptide synthesizers and mapping systems incorporating robotic liquid handling and automated data capture. Leading instrument manufacturers are focusing on end-to-end automation to minimize human error and improve reproducibility. For example, companies like Intavis Bioanalytical Instruments and Gyros Protein Technologies are advancing automated peptide synthesizers and mapping platforms that can seamlessly integrate with downstream analytical tools, including mass spectrometry and surface plasmon resonance. These developments are expected to significantly boost throughput and accommodate increasingly complex antibody and T-cell epitope mapping projects.

Miniaturization is also gaining momentum, with instrument footprints shrinking thanks to advances in microfluidics and chip-based technologies. This enables higher-density peptide arrays and multiplexed assays on a single device, conserving reagents and samples while enabling parallel analysis. Companies such as Fluigent and BC Innovations are actively developing microfluidic components and platforms compatible with peptide synthesis and screening, aiming to make high-throughput epitope mapping accessible in a wider range of laboratory settings, including point-of-care and resource-limited environments.

Looking ahead, 2025 is likely to see the first commercial launches of fully integrated AI-driven epitope mapping instruments that streamline the entire workflow—from peptide synthesis to epitope identification and data interpretation. Cloud connectivity and digitalization will further facilitate remote operation, data sharing, and collaborative research. As biopharmaceutical R&D, vaccine development, and immunotherapy pipelines continue to expand, demand for smarter, faster, and more compact mapping solutions will likely intensify. Industry observers anticipate that these technological advances will not only accelerate discovery but also democratize access to advanced immunological tools, broadening the user base beyond large biopharma to smaller biotech startups and academic laboratories.

Challenges, Risks, and Strategic Recommendations for Stakeholders

Peptide epitope mapping instruments are critical tools for antibody characterization, vaccine development, and immunotherapy research. Despite their growing adoption, several challenges and risks persist in 2025, requiring strategic responses from stakeholders, including manufacturers, research institutes, and end-users.

Key Challenges and Risks

- Technological Complexity and Integration: Many peptide epitope mapping platforms rely on advanced microarray, mass spectrometry, or next-generation sequencing technologies. Integrating these systems into existing laboratory workflows can be technically demanding, requiring specialized training and infrastructure. Leading manufacturers such as Illumina and Agilent Technologies are continuously updating protocols and support systems, but the learning curve remains a barrier for new adopters.

- Data Management and Interpretation: High-throughput mapping generates vast datasets. Proper management, storage, and analysis require robust bioinformatics capabilities, which may not be accessible in all research settings. The risk of misinterpretation or data loss is significant, underscoring the importance of integrated software solutions and support from instrument vendors such as Thermo Fisher Scientific.

- Standardization and Reproducibility: Variability in peptide synthesis, array fabrication, and detection methods can affect result reproducibility. Industry bodies and consortia are working to establish standardized protocols, but inconsistencies persist, potentially impacting regulatory submissions and collaborative projects.

- Cost Constraints: The acquisition and operation costs of state-of-the-art mapping instruments remain high, posing challenges for smaller labs and institutions in emerging markets. While some providers are exploring leasing or pay-per-use models, financial barriers continue to restrict widespread adoption.

- Regulatory and IP Environment: As peptide epitope mapping becomes central to therapeutic development, intellectual property (IP) disputes and evolving regulatory requirements (especially for clinical applications) introduce uncertainty for stakeholders.

Strategic Recommendations

- Invest in Training and Support: Manufacturers and research organizations should expand training programs and offer comprehensive technical support to facilitate integration and operation of advanced instruments.

- Enhance Data Infrastructure: Collaboration with bioinformatics experts and investment in secure, scalable data management platforms can mitigate risks associated with big data and enable more robust analysis.

- Promote Standardization Initiatives: Stakeholders should engage with industry consortia and regulatory bodies to advance standardization efforts, improving reproducibility and confidence in results.

- Explore Flexible Access Models: Instrument vendors can consider innovative business models—such as instrument sharing or cloud-based analytics—to broaden access, particularly in resource-limited settings.

- Monitor Regulatory Trends: Continuous monitoring of the regulatory and IP landscape is essential for early identification of risks and for maintaining compliance in therapeutic development pipelines.

Overall, while peptide epitope mapping instruments are advancing rapidly, stakeholders must address technical, financial, and regulatory hurdles to fully realize their potential in translational and clinical research in the coming years.

Sources & References

- JPT Peptide Technologies

- Bruker

- Thermo Fisher Scientific

- Biomatik

- Sartorius

- European Medicines Agency (EMA)

- Pharmaceuticals and Medical Devices Agency (PMDA)

- Shimadzu

- Gyros Protein Technologies

- Illumina